In essence, a Bitcoin ETF is an Exchange-Traded Fund that tracks the price of Bitcoin, offering investors a straightforward and regulated avenue for investing in this cryptocurrency. It grants you access to Bitcoin without the need to manage the storage of coins or private keys.

Investing in a spot Bitcoin ETF can be advantageous for both professional investors and novices. The choice depends on individual goals, knowledge, and experience.

Experience and Expertise: Professional investors with knowledge of cryptocurrencies and the Bitcoin market can use ETFs to diversify their portfolios.

Risk Management: Professionals are better equipped to manage risk and understand the potential risks associated with ETF investments.

Sophisticated Investment Strategies: Experienced investors may employ more advanced investment strategies in which ETFs can be a valuable tool.

Simplicity and Affordability: ETFs provide beginners with a straightforward and cost-effective means to invest in Bitcoin without the hassle of managing cryptocurrency storage and private keys.

Learning Experience: For beginners, it offers an opportunity to learn about cryptocurrency investing.

Accessible Investments: The Spot Bitcoin ETF allows investments that may have been out of reach for manual Bitcoin accumulation.

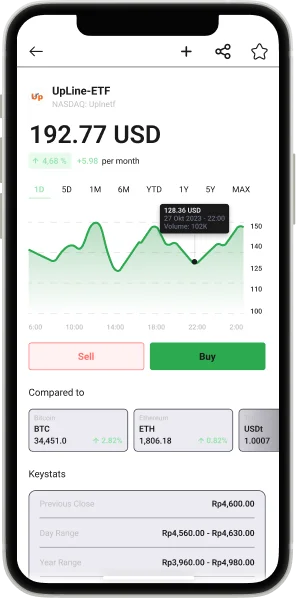

The UpLine-ETF platform offers several unique benefits, making it the ideal choice for anyone seeking to invest in cryptocurrency.

Bitcoin has long been acknowledged as digital gold, and it’s no surprise why. Its limited issuance of just 21 million coins draws parallels with precious metals, making it a rare and valuable asset. However, there’s a way for investors to access this unique cryptocurrency.

Stock exchanges obtain licenses to offer shares backed by Bitcoin. This development paves the way for substantial capital to flow into the cryptocurrency market, potentially impacting the Bitcoin price significantly.

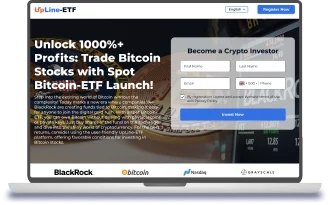

By registering on the UpLine-ETF platform, you gain early access to acquiring shares backed by Bitcoin. This means you can invest and secure this financial instrument before other shareholders.

While there are no guaranteed successes in the world of investments, the right tool, such as the UpLine-ETF software, can certainly simplify the path to financial independence. Bitcoin investing is now affordable, safe, and legally sound, thanks to this intelligent and innovative platform.

UpLine-ETF is regulated by professional and registered brokers, providing investors with additional confidence in the protection of their investments under established laws and regulations. This regulation also appeals to new investors who may have reservations about the safety of cryptocurrency investments.

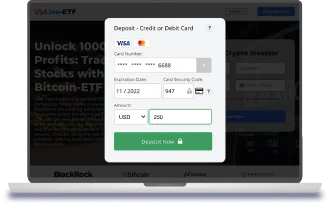

UpLine-ETF enables you to invest amounts that were previously beyond reach for manual Bitcoin accumulation. The minimum deposit is just $250. And no, this isn’t a fee for using UpLine-ETF software but rather your initial deposit as a cryptocurrency investor.

Your personal data and financial information are securely safeguarded through multi-stage encryption. We prioritize protection of the personal information of UpLine-ETF members and do not share it with third parties.

The UpLine-ETF system undergoes comprehensive validation and is continually monitored by experienced computer engineers.

However, the most compelling evidence of UpLine-ETF’s reliability and profitability comes from the experiences of our users. On this page, you can read reviews from UpLine-ETF users.

I entered the realm of investment as a complete novice. Upon learning about the spot Bitcoin ETF on UpLine-ETF, I opted to give it a try. The registration process was straightforward, and I commenced my investment journey with a modest sum. Over the course of a few months, my portfolio flourished, and my confidence in investing grew. I now regularly contribute to my savings, and it’s an exhilarating journey.

As a seasoned investor, I’ve conducted extensive research on various financial instruments. When UpLine-ETF introduced their spot Bitcoin ETF, I decided to experiment. The remarkable regulation and substantial liquidity of this instrument left me impressed. It has seamlessly complemented my portfolio and proved to be a valuable risk management tool.

I had long been in search of a means to safeguard my financial future. The Spot Bitcoin ETF on UpLine-ETF afforded me the opportunity to invest in cryptocurrency without the burden of safeguarding keys. It facilitated diversification of my portfolio and fortified the security of my investments.

Prudent investing with minimal risks has always been my approach, and the Spot Bitcoin ETF at UpLine-ETF aligns with this principle. It granted me the opportunity to acquire a stake in Bitcoin without the complexities of key management. This instilled a sense of confidence in the future.

The Spot Bitcoin ETF on UpLine-ETF has evolved into my preferred catalyst for cryptocurrency investments. The regulatory framework and user-friendliness rendered it an ideal choice. Currently, I’m both acquiring knowledge and accumulating earnings while forging my financial path.

My decision to invest in the Spot Bitcoin ETF on UpLine-ETF was motivated by its robust support network. I had access to invaluable information and guidance that empowered me to make well-informed decisions. Although my investment journey has just commenced here, I am confident in the support available to help me achieve my financial objectives.

The registration form can be found conveniently on this page. All you need to do is fill it out to initiate your membership. Once your registration is verified, you’ll embark on your journey with UpLine-ETF.

Just like any financial venture, you need a specific amount of capital to get going. What’s noteworthy about UpLine-ETF is its reasonable initial investment requirement. You can start the process of generating returns by depositing $250 or more.

After a successful transaction, our representative will reach out to you for confirmation and account activation! If you have any inquiries, our representative will offer comprehensive responses to assist you. Please note that the incoming call might display an unfamiliar number.